Building Our Future

We are part of a global Fast-Moving Consumer Goods (FMCG) company, the fourth largest in our industry sector – and we embrace that. We’re proud to act as a challenger, it makes us agile.

We adapt and respond to consumer needs and market trends, with the ability to develop more innovative solutions than larger competitors, at pace. This flows through every aspect of our business.

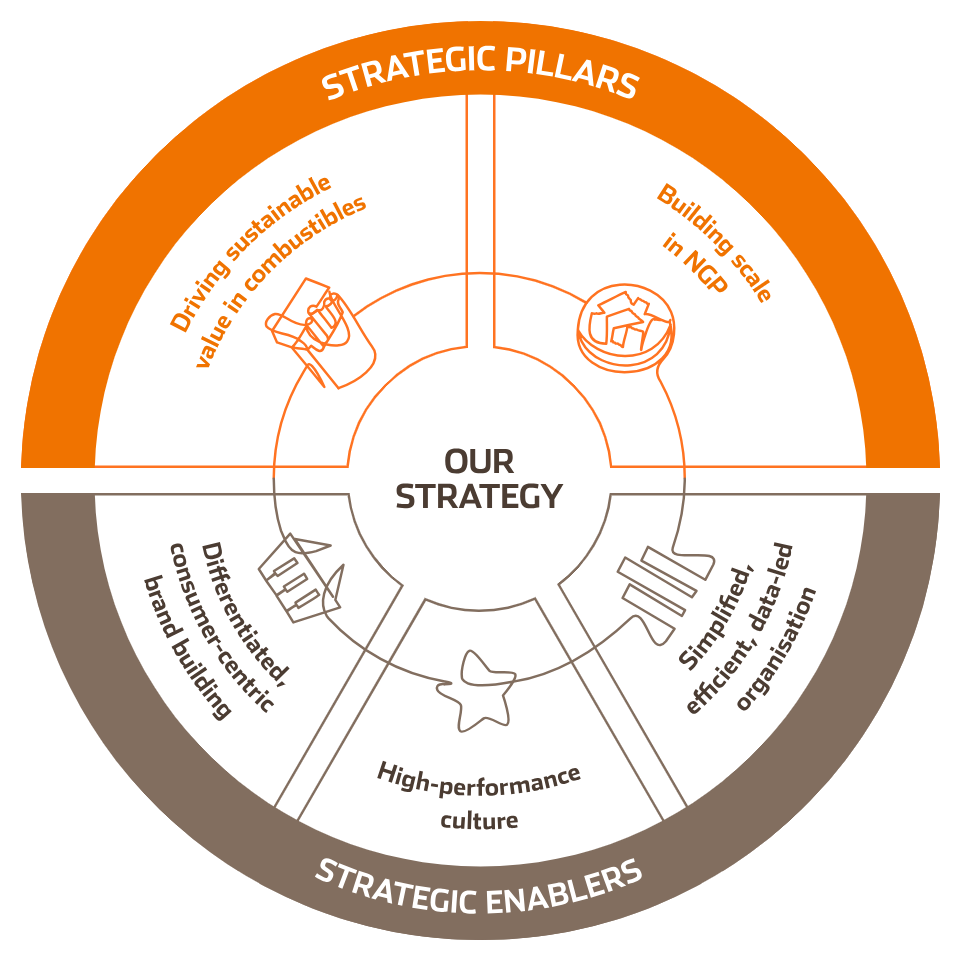

Our Strategy

Our 2030 strategy builds on strong foundations and demonstrates a step-up in our appetite to transform our business.

Strategic Pillars

Our 2030 strategy has two focused objectives:

We have chosen to continue focusing on our five largest markets. The United States, Germany, United Kingdom, Spain and Australia represent c. 70% of adjusted tobacco operating profit – and they will continue to contribute most of our earnings. Within these markets, we have identified specific areas for investment by category, brand and sales channel. Our objective will be to continue to maintain our aggregate market share across these five markets with the aim of driving sustainable growth and cash delivery. By applying this same performance-driven, consumer-led approach to our wider portfolio of tobacco markets, we expect them to make a greater contribution to our overall performance over the strategic period.

We have now built a platform for a fast-growing and agile NGP business, which is founded on a clear understanding of our consumers, credible brands in all three categories, and differentiated products available in all material markets where we have distribution routes.

Our goal is to build scale by further sharpening our consumer insights, leveraging our differentiated brands and developing our sales capabilities. This will build a meaningful NGP business which provides additional growth opportunities and supports our profit and cash performance.

Strategic Enablers

Successful delivery of these objectives will be underpinned by three strategic enablers – key organizational capabilities and ways of working.

We have hired talent with global FMCG backgrounds, and become stronger in insights, brand building and innovation.

We see further opportunities to create further value by refining and focusing our approach.

This includes deeper insights into specific target groups, the development of more differentiated, ‘challenger’ brands, and innovation targeted to address the most important needs of our consumers.

Responding to a legacy of global acquisitions which had been imperfectly integrated, we have been creating a culture where accountabilities are clear, deep collaboration across geographies is fostered and long-term thinking is enabled. Our data shows this emerging performance culture has been a driver of commercial success.

We see opportunities to unlock higher performance by investing selectively in leadership skills, improving business planning and introducing more connected ways of working.

We have begun major data programs, including a new global enterprise resource planning platform, and the full benefits of these will be felt during the next strategic period. And we have now identified further opportunities to create a simpler, leaner and more agile organization.

We will leverage our scale through global business services, drive efficiencies in our supply chain through manufacturing excellence and enable our people to make more informed decisions through better use of data.